The US government has recently introduced the Energy Efficient Home Improvement Credit and the High-Efficiency Electric Home Rebate Program to encourage people to move towards more sustainable heating and cooling systems.

Wondering which heat pump system fits the criteria or whether a heat pump is the best option for your home? We’ve gathered all the information you need and are here to point you in the right direction about the available tax credit and rebate savings.

The Inflation Reduction Act

You don’t need to know every detail of the Inflation Reduction Act. But here’s a quick summary to help you understand what it covers.

The Background

Global climate change is a continuing global issue, and the US is determined to play its part in reducing carbon emissions and creating a better world for future generations. One example of this is the Inflation Reduction Act passed in August 2022.

After a year of negotiating, this Act pledges more money towards climate initiatives than any previous US Federal Government. In addition, by offering cash incentives to homeowners willing to switch to greener energy sources, it’s hoped more people will join the climate campaign.

What the Act Means for You

Let’s break it down to see how you can save some cash. First, if you’re looking to adopt eco-friendly energy alternatives such as heat pumps, top-notch exterior doors, efficient appliances, and electrical panels, you can apply for Energy Efficient Tax Credits for up to $1,200. These credits are available to help you offset the expenses of energy-saving home improvements.

What Is a Heat Pump?

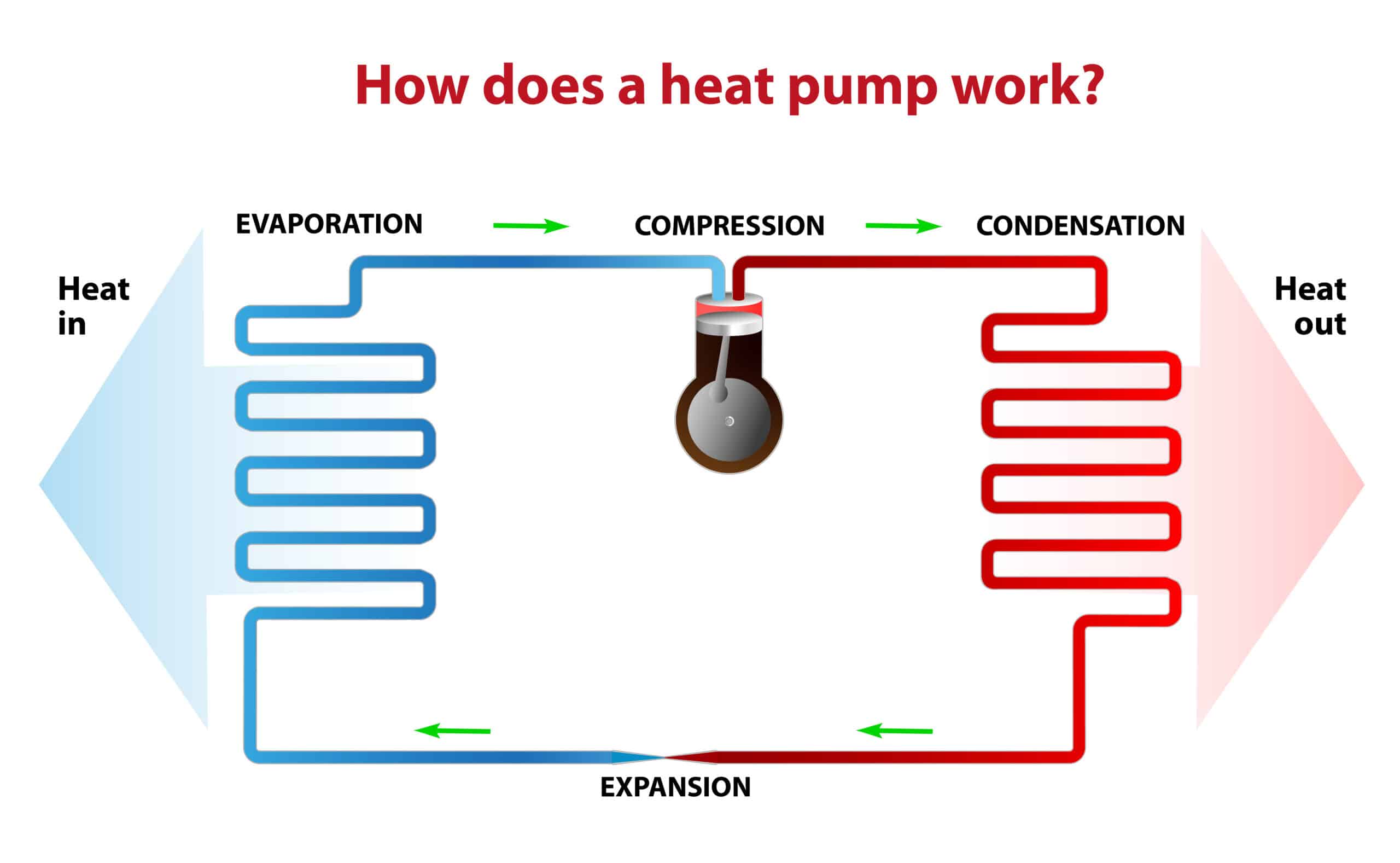

Rather than using fuel to power your HVAC system, a heat pump transfers heat to keep your home comfortable. Heat pumps generally use heat from the air or ground and pump it around the system using electricity.

- The system uses a cold refrigerant to absorb and release heat.

- The refrigerant absorbs heat from the outside ground or air. As it passes through the outer coil, it begins to evaporate and turns to gas.

- The gas passes through the system until it reaches a compressor, where it’s heated further.

- Once the gas reaches the indoor section of the system, it passes through a condensing coil.

- As the gas condenses, it releases the trapped heat into your home.

- The condensed refrigerant is pumped back into the outer coil, and the process starts again.

The benefit of heat pumps is that you spend less on your energy bills because you’re tapping into natural heat sources instead of burning fuel.

The benefit of heat pumps is that you spend less on your energy bills because you’re tapping into natural heat sources instead of burning fuel.

Benefits of an Energy-Efficient Heat Pump

There are several benefits to having a heat pump installed, including:

Lower Utility Bills

Energy-efficient heat pumps can reduce your energy costs. These systems optimize usage to conserve energy, meaning you may have lower utility bills and less wear and tear on your system.

State Requirements

Zero-carbon emissions policies are becoming commonplace in many states as part of a wider government initiative. Your state may require energy-efficient upgrades to support this cause.

Eco-Friendly

Energy-efficient heat pumps don’t just save money. They’re better for the environment because they don’t use more energy than they need to keep your home cozy.

Which Systems Qualify?

Before rushing out to buy a heat pump to lower your energy bills, there are a few things to keep in mind. Although switching to a heat pump may seem appealing, not all are eligible for tax credits or rebates. It’s essential to research or consult with your local HVAC experts to determine which heat pumps meet the qualifications for savings. In general, here are some guidelines to follow.

Energy Star Systems

Do you want to ensure that you purchase a high-quality heat pump or any other household appliance? Keep an eye out for the Energy Star Efficiency Certificate. This certification is awarded to products that have undergone rigorous testing. Once issued, it proves they’ve met the energy efficiency standards (established by the US Environmental Protection Agency or the US Department of Energy). What’s more, Energy Star certified products are required to meet the credit and rebate savings requirements.

Different Systems Covered

Not sure if a heat pump is right for your home? The best way to find out is to speak to your local HVAC professionals. If a heat pump isn’t suitable, don’t despair. You can still benefit from the savings by replacement installation of a new boiler, HVAC system, or furnace.

CEE Tier 1 & 2 Requirements

To qualify for the savings, your heat pump must fit within Tier 1 or 2 as set out by the Consortium of Energy Efficiency (CEE) These tiers indicate that the product is more efficient than those without the rating.

What Federal Tax Credits Are Available?

Tax 25C

Tax 25C

This tax credit is a nonbusiness property energy credit. It allows you to claim up to 30% capped tax credit for installing energy-efficient products like heat pumps, water heaters, and electric panels or for carrying out energy audits.

The excellent news about this credit is that it’s not a lifetime credit. It renews yearly. Anyone with adequate tax liability to offset can qualify for Tax 25C.

Tax Credit Amounts

There are various amounts allocated to different products and appliances. However, the principal amounts are as follows:

- Heat Pumps – up to $2,000

- Air Conditioners – up to $600

- Furnaces – up to $600

HEEHRA Act Energy Efficiency Rebates

Even if you’re on a tight budget, you can still benefit from the HEERA rebates program. For example, if your household income is 80% less than the average income in your area, you can receive a full rebate for a new heat pump purchase of up to $8,000.

Plus, households with income levels between 80% and 150% of the median average income are also eligible for a rebate of up to 50%.

Plus, households with income levels between 80% and 150% of the median average income are also eligible for a rebate of up to 50%.

And it’s not only heat pumps available for rebates. You can add other energy-saving appliances and measures to the list, including:

- Electric stove/cooker top $640

- Electric wiring $2,500

- Weatherization $1,600

- Heat Pump Water Heater $1,700

So, whatever your income, you can benefit in the future from lower energy bills.

Save More with Local Energy Rebates

There are a host of other payments you could be eligible for in return for switching to more sustainable energy sources and appliances. For example, choose an Energy Star Certified product and you could get a rebate or discount from $30 to $200 (depending on your area). The Energy Star Rebate Finder is an excellent tool to help you figure out your eligibility.

Equally, individual utility companies have their own energy authorities and programs offering localized financial incentives. So checking with your local utility provider is worthwhile to see if you qualify for further payments.

Combining State and Federal Rebates

As the IRA law is relatively new, only coming into play in January 2023, the rules around combining State and Federal rebates need to be clarified. In short, it’s down to the individual State and how they interpret the new rebate and tax credit system.

However, as long as the Federal Government isn’t funding the State rebates, you should be able to qualify for both.

How to Apply for Tax Credits and Rebates

How to Apply for Tax Credits and Rebates

What’s the difference between a tax credit and a rebate? It’s reasonably straightforward.

For those on a low to moderate income, as determined by the HEEHRA, a rebate acts like a discount at the time of purchase. So you find a listed contractor (DIY projects don’t qualify) to install your heat pump, they handle the paperwork, and you get a final bill minus the rebate amount.

Whereas for higher-income families, a tax credit is applied. In contrast to a rebate, you pay full purchase and replacement installation costs. However, you claim back up to 30% via your yearly tax return, either getting a lower bill or a larger tax refund.

Tax forms can sometimes be tricky to fill in, so if you need help with applying for the tax credit, we recommend getting the advice of an experienced tax consultant.

Are you ready to switch to a federal energy efficient heat pump? Contact the HVAC experts at HELP for professional advice and guidance.

Tax 25C

Tax 25C How to Apply for Tax Credits and Rebates

How to Apply for Tax Credits and Rebates